TurboTax is used by a number of users for their tax preparation. It is one of the finest software that makes tax preparation an easy task. You just need to give some basic information and that’s all. The hectic process of tax preparation is now a no time job. While using the software, the user sometimes gets confused about which version they need.

When they don’t have the proper knowledge, they end up buying the wrong version. The software offers various versions like TurboTax refund advance and all. The good thing is that you can anytime downgrade the version; you may ask how to downgrade TurboTax? So we have listed some simple steps below that can help you.

Downgrade TurboTax Version

There are always high chances that you have started with the wrong version of the software. It is not an issue; this happens with most of the users. This is because of the lack of clarity between the versions. Some have fewer features, and some have a gamut of features. TurboTax calculators are also a prime feature of the software.

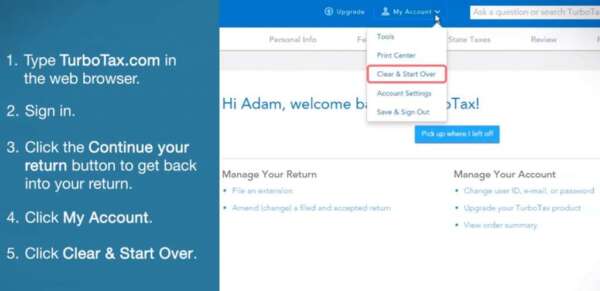

Now suppose you wanted to buy a deluxe version and ended up buying premium, then it’s a loss for you. In such a case, you can downgrade the version, but the condition is that we have only one way to do that. We call it “Clear and Start Over,” only this method can downgrade it. You need to have a TurboTax login for that and if you are getting TurboTax login problems, then resolve it and then move ahead.

In this method, you may assume that all your data will be deleted, not this is not gonna happen. Your data and the account information everything is safe; you will not lose anything. But one thing that you need to keep in mind is that the information you have entered will be at risk. This information is the only single thing that might get deleted. Now one of the most vital things is that you need to start from scratch after using the clear and start over method.

Also Read: How to recover deleted files on Android

This can be a hectic process, but you need to do it once, and then it will be saved. You need to enter the details and all the required information to continue. This includes your tax information as well. You have to do this because this is the only way to downgrade TurboTax refund calculator software. Now below are the steps that you need to take to complete the process.

You just need to follow the instructions as stated, and then your issue will be resolved.

- Head over to the online TurboTax account, and then you need to look for the “My Account” option.

- Under my account section, you will get the option of “Clear & Start Over.”

- As you select the option, you will be taken to the starting of your return.

- Now re-enter all the asked information and details correctly, cross-check them at least once.

That’s all you need to do to downgrade your current version of the TurboTax using the clear and start over method. If you find any issue in between the process, then try repeating the steps and get rid of the problem.

Login Issues with TurboTax

It is one of the common problems that TurboTax users encounter; it can be resolved easily in no time. Because of this, you may face restrictions in the services like TurboTax refund tracker issues. So below are some reasons that cause the issue; you need to look for them and then go for the solutions.

- It might be the issue of your configuration with the system.

- In case you’re JavaScript or cookies are not enabled, then you might face the same issue.

- Wrong credentials are also one of the prime reasons to cause login problems.

- Issues with your internet connection or lousy connectivity can lead to such a scenario.

These are some of the main reasons that are responsible for causing various issues, including TurboTax login problems. It will be easier to find the exact solution if you know the cause of the problem. Check out the complete blog for in-depth information.